Learn how to apply for the Savor Cash Rewards

Find out how to apply for this card if you're the type of person who frequents restaurants and events frequently.

What do I need to know about the Savor Cash Rewards?

The Capital One Savor Cash Rewards Credit Card may be for you if going out is just another night for you.

This card offers an amazing 4% cash back rate on eating, streaming, and entertainment purchases that is unlimited, in addition to a generous 3% back at grocery stores and 1% back on all other purchases. Additionally, it offers one of the largest sign-up bonuses for a cash-back card currently available.

Card Application

Savor Cash rewards

Tap on the green button and apply for the Savor Cash Rewards

Apply now!* You will be directed to an external website

The catch? The cost is $95 per year.

And that’s pricey for a cash-back program, especially given the availability of complimentary cards with similar food-related features.

However, the benefits may outweigh the cost for individuals who often dine out at sit-down restaurants and fast food outlets, go to movies and plays, and hang out in nightclubs, coffee shops, or even bowling alleys.

With the Capital One Savor card, redeeming rewards is straightforward. Cardholders have the option of requesting rewards as a statement credit or check.

Other techniques to automate cash-back redemptions include an annual automatic redemption date and an automatic redemption threshold.

After the user-specified threshold has been met, the predetermined amount will be credited or released. These allocable amounts start at $25 and increase progressively to $1,500.

Rewards can also be converted into purchases, gift cards, and other incentives, albeit the percentage of conversion may vary.

You can also book travel on CapitalOneTravel.com by using your rewards.

Although the redemption rate is less than one cent per point, certain websites allow cardholders to utilize rewards they have accrued to make purchases.

How much money can I get from cashback?

To evaluate the rewards potential of the Capital One Savor card, we must look at the bonus categories and make an educated guess as to how much an American household might spend on each one.

The 70th percentile household income, or $107,908 annually, serves as our benchmark for spending.

Assume that the $7,057 in dining, entertainment, and streaming costs for our fictitious household result in an annual cash-back reward of $282.28.

The household would receive $186.93 in cash back for the remaining $18,693 that could legitimately be charged on a credit card and $189.66 in cash back for the $6,322 it spends on groceries.

This suggests that the card would receive $658.87 in cash back year in addition to the welcome bonus.

Who can apply for the Savor cash rewards?

Despite the usual stuff, like being older than 18 (21 in some states) and residing in the U.S.A., there are some catches

You have a decent chance of getting approved for the Capital One Savor Card if your credit score is 700 or higher and you make enough money to pay your bills on time each month.

How to apply for the Savor Cash Rewards?

To apply for the Savor Cash Rewards, simply visit the Capital One website. As per usual, a form will appear on which you may enter your contact, financial, and personal details. Accept the terms in this form, and you’re done.

Is it worth it to apply for the Savor Cash Rewards?

For people who enjoy dining out and entertainment, anticipate spending enough to be eligible for the welcome bonus, and travel overseas, the Capital One Savor card has many advantages.

The people who stand to gain the most from this card are possibly those who spend a lot of money on meals and entertainment while visiting other countries.

Using this card will probably be quite advantageous for those who combine it with another, all-around superior cash-back rewards card.

For balance transfers or people who don’t want to deal with the annual fee, the card is not very useful.

For cards with annual fees, a rigorous study is always advised, especially if the spending threshold for the welcome bonus appears reasonable.

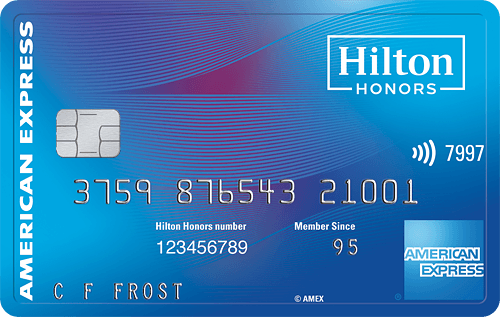

Savor Cash Rewards vs Hilton Honors American Express Card

These card pairs up pretty well if you are the kind of person that travels a lot.

The Savor Cash, as we have seen, is an amazing card for cashback if you are the kind of person who wants to go out a lot. And who goes out more than the one who travels? That is where the Hilton Honors kicks in

By learning how to use both, if you are a traveler, this can be your deadly duo.

Savor Cash Rewards benefits

- 4% back in cash on qualifying categories

- An uncommon rewards category card is entertainment.

- Absence of foreign transaction fees

- Continually earn rewards

Hilton Honors American Express Card benefits

- High rates of point earnings

- Generous introductory bonus

- Fifth night free on award stays is included with automatic Silver level.

- No annual fee

How to apply for the Hilton Honors American Express Card?

If you are looking for a card this good, check out on how to apply.