Learn How to Apply for the Discovery Bank Platinum Suite Credit Card

The Platinum version of Discovery Bank offers more favorable rates for managing your account daily, both domestically and internationally.

What to know before applying?

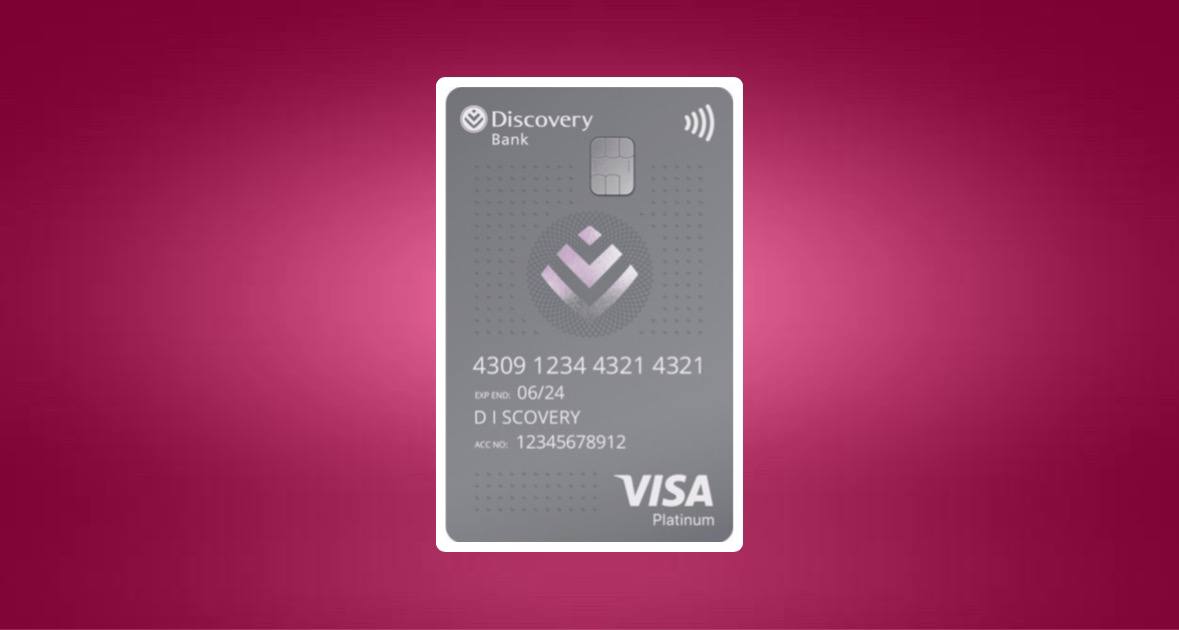

The Platinum Suite is the credit card to take full advantage of your Discovery Bank account benefits, including 3 accesses to SAA lounges at various airports across South Africa.

CREDIT CARD

Discovery Platinum Suite

Want a great version of Discovery? Apply now.

GO TO OFFICIAL WEBSITE* You will be directed to an external website

The Suite Platinum is an account from Discovery Bank designed for individuals with incomes ranging from R350,000 to R850,000, featuring a monthly fee of R289.

This fee covers an account fee of R160, Vitality Money at R60, and a facility charge of R69.

According to Discovery Bank, the account provides a wide range of benefits as part of a comprehensive banking package, including the Platinum credit card, which is usable anywhere with the Visa Platinum brand.

For rewards, the bank offers versatile Discovery Miles along with additional cash-back benefits in the following areas:

- Up to 50% off on purchases at Pick n Pay or Woolworths

- Up to 50% cash back at Clicks or Dis-Chem

- Up to 15% cash back at Shell and BP fuel stations

You can redeem your Discovery Miles for discounts on:

- Up to 15% off at over 40 partner stores

- Up to 15% off on prepaid electricity, credits, data, or digital vouchers

- Up to 15% off at Vitality Mall

You can also use your miles for flights, hotel stays, or cash. For travel-related benefits, the card provides:

- Discounts of 10% to 60% on six one-way domestic flights with partner airlines

- Savings of 10% to 35% on regional bookings

- The option to purchase tickets directly through the app

- Complimentary travel insurance

Who can Apply?

To open a bank account, you need to be:

- A registered South African citizen who is 18 years old or older. Foreign nationals will require a valid passport and a visa.

- The main criterion for getting the card is income, with a required annual earnings range of R350,000 to R850,000.

Before applying, gather essential documents such as proof of income, a copy of your ID, recent pay stubs, and evidence of your address.

How do I Apply for the Discovery Bank Black Platinum Credit Card?

To obtain the card, you need to have a Discovery account.

On the official card page, you’ll find the login option in the top menu. If you are not a South African citizen, you’ll need to create a new account by providing your South African ID number or passport number as the initial information.

Next, you must provide additional essential details for setting up a bank account, including your full name, address, and country of birth.

For income verification, you should provide information about your earnings and their sources.

It’s important to note that this doesn’t have to be just a salary; other income sources such as investments or benefits are also acceptable.

After setting up your account with Discovery Bank, you can establish your credit criteria to apply for the card.

Thus, unlike other credit card applications, you are applying for the Black Suite, which encompasses all the benefits offered by Discovery Bank.

If you have any questions or encounter issues, you can contact the bank’s customer support.

CREDIT CARD

Discovery Platinum Suite

Like the benefits? Apply now.

GO TO OFFICIAL WEBSITE* You will be directed to an external website

More Details

In collaboration with SAA, the card provides access to airport lounges, including up to 2 domestic departures and 1 international visit.

It also offers discounts on cruises, hotel stays, and car rentals with Europcar.

The Vitality Money system evaluates up to 5 financial factors to determine your financial health score and points, and it enables you to earn rewards.

Additionally, you will receive detailed insights to enhance your credit opportunities.

Forex accounts are available 24/7, allowing real-time conversions to USD, EUR, and GBP.

The card can be used with a PIN, chip, or digital version, all with comprehensive security and management through the Discovery Bank app.

This makes the card highly adaptable and secure for global use.

Want to learn about another option?

Discovery Bank offers its Black version to provide even greater strength and quality in managing your bank account.

In this way, you will also benefit from enhanced security and exclusive discounts, and you can find out how to apply.