Learn How to Apply for a Simply Cash Preferred Card

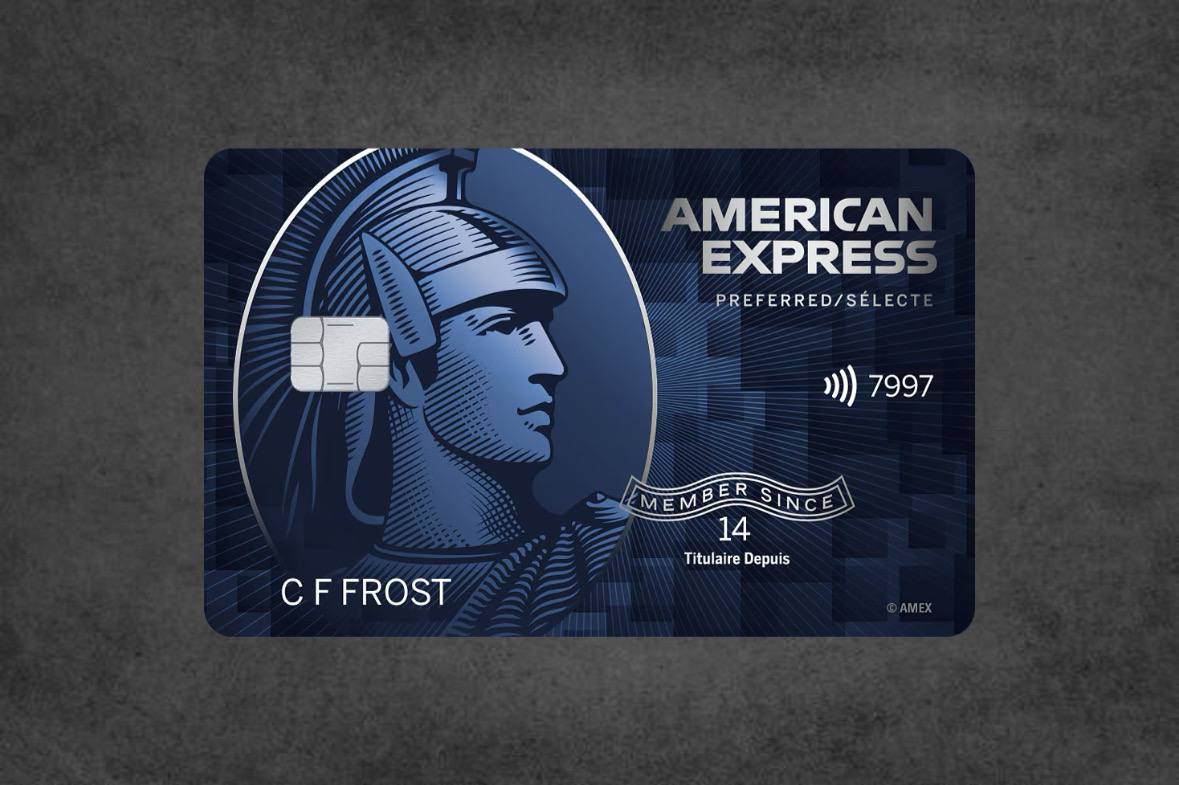

The Simply Cash Preferred is an American Express credit card that brings a great experience to daily life in Canada.

What do I need to know before applying?

The Simply Cash Preferred Card is a cashback card that offers up to 4% on grocery and gas station purchases!

CREDIT CARD

Simply Cash Preferred

Want an Amex card? Go ahead and apply.

GO TO OFFICIAL WEBSITE* You will be directed to an external website

American Express is a prominent credit card issuer in North America, with a presence that extends throughout the continent beyond just the USA.

In this context, it offers its services in Canada, featuring the Amex SimplyCash Preferred as one of its top choices.

This card comes with several bonuses, including 10% cashback on all purchases for the initial 3 months, capped at $200, and an additional $50 in statement credits for purchases made in the 13th month.

Furthermore, you can earn up to $750 in annual cashback by referring friends who apply for the card.

The credit limit is largely influenced by the specifics of each application, including credit history and income.

As a result, you can anticipate high limits when using the card. In terms of expenses, the card incurs a monthly fee of $9.99, which totals $119.88 annually, along with an annual interest rate of 21.99% for purchases and cash advances.

The card provides varying cashback rates, which include 4% on gas for qualifying purchases at gas stations, 4% on groceries for qualifying purchases at supermarkets, and 2% on all other categories.

By referring a friend, you could earn up to $750 in cashback over the course of the year. The American Express card has received numerous accolades, particularly for its strong cashback rewards.

Additionally, it features mobile device protection insurance, covering theft or damage for phones purchased with the card.

Who can Apply?

The American Express card has specific requirements related to creditworthiness.

To qualify, you must be a citizen aged 18 or 19, depending on your province of residence.

Moreover, you should be correctly registered in the country, either as a Canadian citizen or as a foreign national with a valid passport and visa.

To obtain the SimplyCash card, it is essential to have a good credit score, be free of debt, and provide information regarding your income.

All applications are subject to approval by American Express.

How do I Apply for the Simply Cash Preferred Card?

On the card’s webpage, you’ll find an ‘Apply Now’ button to initiate the application process.

Clicking this button will take you to a page where you can confirm and agree to the terms. American Express promises to provide a response within 60 seconds.

Here’s the information you’ll need to complete the application form:

- Your first name, last name, card name, email address, date of birth, postal code, social security number (optional), and any existing American Express card number (optional);

- Your phone number, complete address, and housing type (owned, rented, etc.);

- Financial details, including your job type, payment frequency, income, and spending ratio.

Once you’ve filled out the form, you can submit your application for American Express to evaluate.

The company promises a faster response time than many competitors, but you can always rely on Amex’s customer service for any inquiries you may have.

During the application process, you might need to provide documentation to verify your identity and income.

CREDIT CARD

Simply Cash Preferred

Want to live the Amex life? Apply now.

GO TO OFFICIAL WEBSITE* You will be directed to an external website

More Details

The card offers a wide range of benefits, including exclusive American Express experiences such as early access to ticket sales, special reservations, entertainment events, and dining opportunities.

In line with Amex’s high standards, the card also enhances your shopping experiences while traveling and grants you access to the American Express Lounge, adding a touch of luxury to your SimplyCash experience.

Regarding security, the card provides 24/7 customer support, emergency card replacement, a fraud protection guarantee, and the complete American Express app for managing your account online.

Additionally, the card includes exclusive offers from American Express on shopping, dining, and travel.

Want to learn another option?

Want a truly different card? Then check out the Neo Money Card, which integrates your account with your everyday spending to earn cashback.

The approval process for the Neo card is much simpler, as it is a basic credit option. Here’s how to apply.